Microfinance works to improve economic conditions for poor clients, help them increase their incomes and improve their lives, by providing financial services to them. In fact, the poor often have difficulty accessing formal financial services due to a number of barriers, especially without collateral, when accessing formal credit services. In addition, MFIs are aiming to provide long-term clients with the ability to access sustainable financial services. Thus, microfinance is considered as a development tool for the poor, not just a financial service and it targets the following specific development goals:

• Create jobs, increase income for the poor.

• Capacity building for target groups, especially women.

• Reducing the vulnerability of the poor when facing difficulties or unexpected risks.

• Helps the poor to develop sustainably.

In the past, microfinance has been seen as an effective tool in poverty reduction strategies in developing countries and has attracted the attention of governments, donors and practitioners. In Vietnam, over the past two decades, along with innovation, microfinance has contributed positively to the fight against poverty, contributing to local economic development and supporting balanced development. between regions. With a wide variety of models and activities, formal and informal MFIs provide opportunities for the poorest and poorest households, especially in rural areas, to access credit services. and savings to develop business activities, generate income. Many poor households have significantly improved their economic conditions after participating in the financial services of microfinance institutions/ programs.

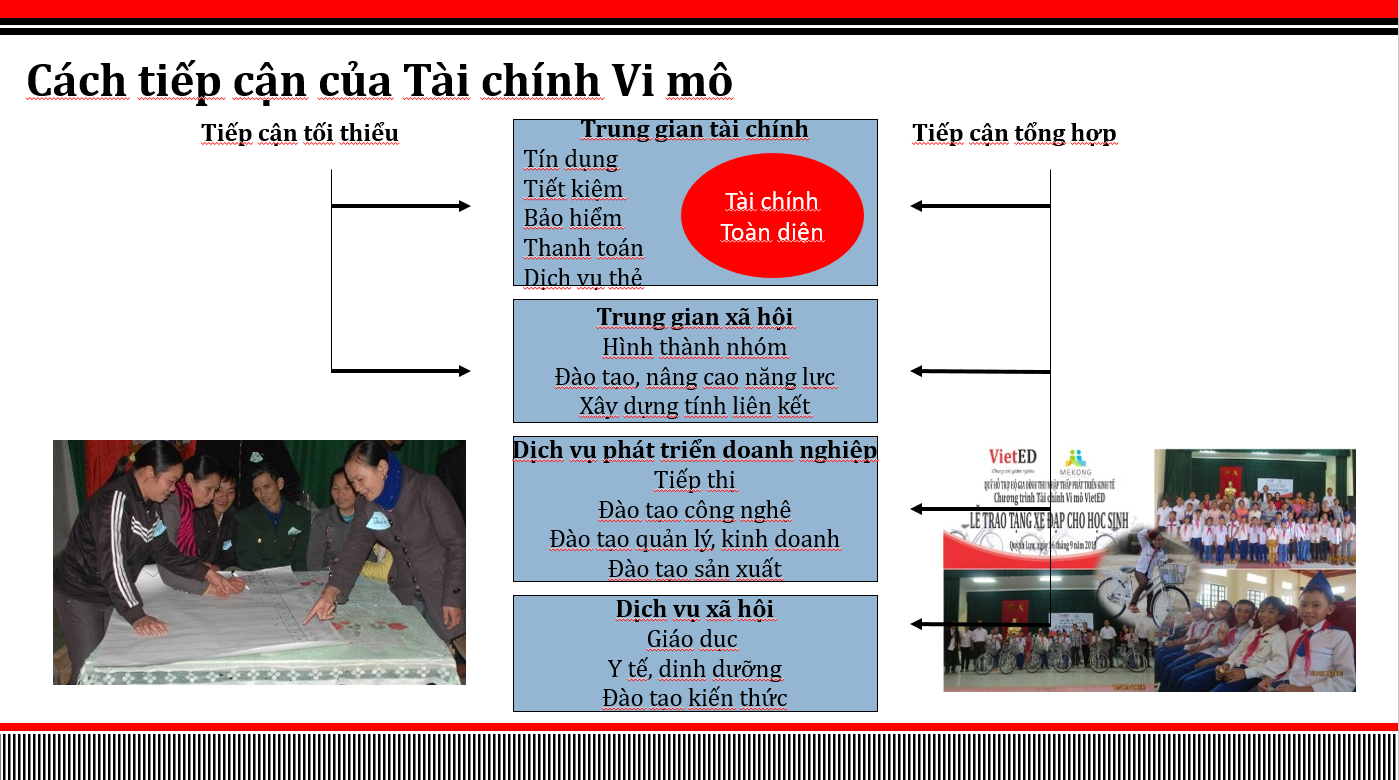

Microfinance has been a part of Vietnam’s dramatic poverty reduction in recent years. In addition to the provision of financial services, many microfinance programs / programs have provided other non-financial services to their clients, in particular support for the development of capacity for the group and its members, Social services such as education, health care, nutrition, environmental sanitation etc. Microfinance also focuses on female clients with a view to empowering and improving gender equality.

After more than 20 years of implementation in Vietnam, microfinance has contributed significantly to the poverty reduction of the Government. The economy is improving, people’s life is improved. The development of the financial system in recent years has facilitated the process of microfinance in our country to continue to make stronger progress. MFIs in Vietnam have gradually completed six aspects of development: serving more customers, better quality, low cost, durable and profitable operations, services diversity and abundance. However, besides the early successes, microfinance still has many problems that need to be overcome in order to rise and affirm its position and importance in the current Market-based economy.

The VietED Fund is a microfinance organization established under Decision 977 / QD-BNV dated 28 April 2011, and Under Decree No. 148/2007 / ND-CP of the Government dated 25 September 2007, Decree 30 is now in effect. VietED operates in a self-financing manner and is responsible to the law and not for profit target. From its inception to the present, VietED Fund has been continuously developing and expanding its scope and scope of activities to many provinces and cities nationwide with the head office in Hanoi and 03 branches in Quynh District Luong – Nghe An (2011), Hiep Hoa – Bac Giang (7/2014) and Thanh Thuy – Phu Tho (3/2015), Ba Vi district – Hanoi (10/2017).

The main activity of the VietED Fund is to provide microfinance services with appropriate loan products so that more and more poor people and micro enterprises can access loans they can not obtain from the traditional banking.

In order to be able to implement effective microfinance, the microfinance process and operations of the VietED Fund are implemented in the following steps: Firstly, to survey the needs of people in the province, district, commune and village. From the results of the survey, the Fund will design products such as Loans, Savings, Microinsurance, … in line with demand. To obtain funding for lending, the Fund will call for sources, seek donors, social investors. A typical call-up tool currently being implemented is the Common Poverty Reduction Agenda with two modes Offline and Online (the gateway calls VietGiving, in cooperation with GPAY Vietnam). Once the funds have been obtained, the VietED Fund provides small loans of less than $ 30 million in the form of monthly installments of both principal and interest plus a compulsory savings for that month.

In parallel with providing traditional microfinance products and services, VietED also develops additional products and services such as providing education services, implementing training courses and training for people. Basic knowledge of business skills, sustainable livelihoods, financial management of family and business, gender and gender equality, etc., to improve people’s skills in all aspects. the necessary field in life for sustainable development. As a result, the poor and disadvantaged people not only have the money to do business, but also have the basic knowledge to use the loan effectively, increase income for the family from which to have a good life than. In addition, VietED also develops value chains: geographical indications, collective labels, certification marks, brand building and development, and market connectivity for local products, Creation and development of associations, cooperatives, manuals for implementation …, help people assert their position in the market, thereby increasing employment, improving the lives of people. in many parts of the country. A number of typical projects such as VietHarvest brand with Department of Science of provinces; Social Enterprise: Corporate Social Responsibility Network -SRB Network, has launched the brands such as Shan Snow Moc Chau, Pineapple Quỳnh Lưu Nghệ An, Kim Son Artistic Rice, Ngao Kim Son, Stone Ninh Van Handicrafts, La Xuyen Handicrafts, etc.

Since its inception, VietED Fund has made significant contributions to the economic development of many households through the provision of small loans, contributing to improving the performance of the microfinance industry. It is from these efforts of VietED in particular and MFIs that more and more people are acquainted with microfinance. The performance of VietED can be seen through successes such as:

– Through the microfinance program, the VietED Fund has created hard working and creative labor force in order to diversify income sources for households and at the same time give them the habit of saving. So all borrowers have savings accounts;

– Generate significant social impacts thanks to the provision of microfinance services, such as increasing the solidarity and mutual support among group borrowers during the repayment process. This is particularly evident in the group lending method of microfinance (76% of the members support each other);

– Thinking of poor people is also changing in a positive way. They are no longer waiting for free support or policies from the State, but rely on themselves to rise while also helping other poor to develop the economy;

– In addition to these impacts, the VietED Fund also participates in technical assistance, organizing training courses, financial education, business skills development and output connections for customers’ products;

– Another significant contribution of VietED in the microfinance industry in Vietnam is the development and standardization of microfinance documents and updates on microfinance practices, trends, microfinance, information technology, etc. in the world. or cooperation in training courses on risk management, operation management, financial analysis, etc., to support other microfinance institutions to implement, contributing to the success of domestic microfinance and in the area.

|

|

|

|

|

|

Some reasons for the success of VietED Micro Finance:

– There is a clear business strategy (this business plan is updated annually, revised and supported by experts, including the impact from training courses such as the ADB Project with the State Bank) The

– Diversify products to meet customer needs (agricultural loans, business loans, consumer loans, insurance, customer capacity building, product branding, and market connections. );

– Developing projects, expanding relations with donors, channels to create capital for lending activities in order to expand the market and develop customers;

– Develop and implement procedures and regulations in accordance with international standards as well as legal regulations for Microfinance (VietED Micro has not yet been officially registered but has always considered itself transformed and implemented in accordance with legal regulations, which helps VietED to be ready with new regulations when converted into formal MFIs);

– Participate actively in the microfinance sector, participate in open dialogues with state management agencies: Program / Project (ADB, AFD), conferences, seminars , training or activities in the microfinance sector in Vietnam and the region (Legal framework, Risk Management, Credit Management)

Some difficulties, challenges and suggestions:

– First, it is difficult to create a source of lending – a very important activity in the process of expanding clients and locations. Not being implemented as a financial intermediary causes Microfinance programs to grow slowly. This is to ensure the safety of unsecured credit operations. However, while the government annually provides large amounts of funding and funding to the VBSP, microfinance does not receive any incentives. At the same time, other investment options are almost closed with organizations such as VietED. In terms of foreign borrowing, since the object is only an enterprise, funds or non-governmental organizations are not subject to adjustment. Self-Paying Loans are not available. It can be said, in the source mobilization issue, the microfinance is “tied up”. Creating a source is a vital issue for MFIs, but now that all roads are barricaded, this is a turning point for Vietnam’s microfinance development. Decision No. 20/2017-QD-TTg stipulates that microfinance programs are entitled to borrow capital in accordance with the law. This is a new regulation that opens the way for microfinance to access capital for development. / 2017-QD-TTg also restricts the Microfinance Program to mobilize sources from the market (up to 30% of equity).

– The second difficulty in microfinance comes from the government. Despite the fact that microfinance is an effective tool for poverty reduction and community support, most provincial and district PCCs, including SBV branches in many provinces do not understand much about microfinance operations, Think of this as a very small area and subsidized credit so little attention to. This makes microfinance not become professional financial activities, leading to difficulties of the organization when implementing the implementation of microfinance program. This is a great challenge for Vietnamese microfinance in general and VietED in particular, which limits the ability to create and use resources, sustainable development;

– Another problem is that many levels of government set the interest rates applied in Microfinance programs to be very low for the poor. In practice, however, the poor need access to services and support rather than interest and fees. Meanwhile, the high costs of microfinance programs put support services to the village, the capital is very small ..vv, higher than the current commercial banks;

– The ability of state agencies to supervise microfinance activities is limited. The staff of microfinance institutions that oversees, manages and manages microfinance operations is often volatile, making the regulation of regulation of the microfinance industry unsuitable. over time, many regulations are not suitable with practical activities;

– The current legal framework for microfinance is also a challenge for organizations wishing to transform into a licensed microfinance institution. Circular No. 03/2018 / TT-NHNN dated 23/02/2018 clearly shows that the conditions for conversion have changed and there is a tendency to increase the conditions on the applicants to be established as barriers for the groups. want to switch to formal MFIs;

– On the other hand, there is no clear guidance on the standard IT system, as VietED and other microfinance institutions are not clear. VietED adopts open source software is popular in countries around the world, do not know whether meet the conversion requirements?;

– The time for licensing the establishment of MFIs is long, time-consuming, the organizations have converted on average over one year;

– The lack of comprehensive assessment information on all ongoing microfinance operations is also an issue that needs to be improved. At present MFWG has MFWG, but its operation is not linked. MFIs are still operating independently. Each MFI is focused on specific areas, lack of exchanges. mutual learning between organizations. In the coming time, priority should be given to supporting the establishment of the Microfinance Association, the microfinance network.

Microfinance is growing, contributing greatly to the poverty reduction of Vietnam and the world. The microfinance market in Vietnam is a potential market with a high proportion of low income people (> 50%) and up to 70% of people are in rural areas. The formation is still small, scattered. Therefore, the challenges faced by MFIs need to be quickly resolved and further supported by the Government, the SBV and authorities, The microfinance is widely developed and becomes an effective tool for poverty reduction. VietED expects that the development of the VietED Fund in particular and that of the Vietnamese microfinance industry should in general be aimed at becoming a “Professional Microfinance Institution, becoming a Financial Intermediary and a Social Intermediate” by expanding it. Capital, diversification of financial and non-financial products, thus providing the poor with access to capital and social services, employment, income generation and quality of life.